Blogs

Best Practices for Accurate Revenue Recognition for Your E-Commerce Store

In the world of e-commerce, businesses often receive bank transfers or deposits from platforms like Shopify, Amazon, Walmart or eBay as part of their sales o...

January 30, 2025

0

min reading time

Blogs

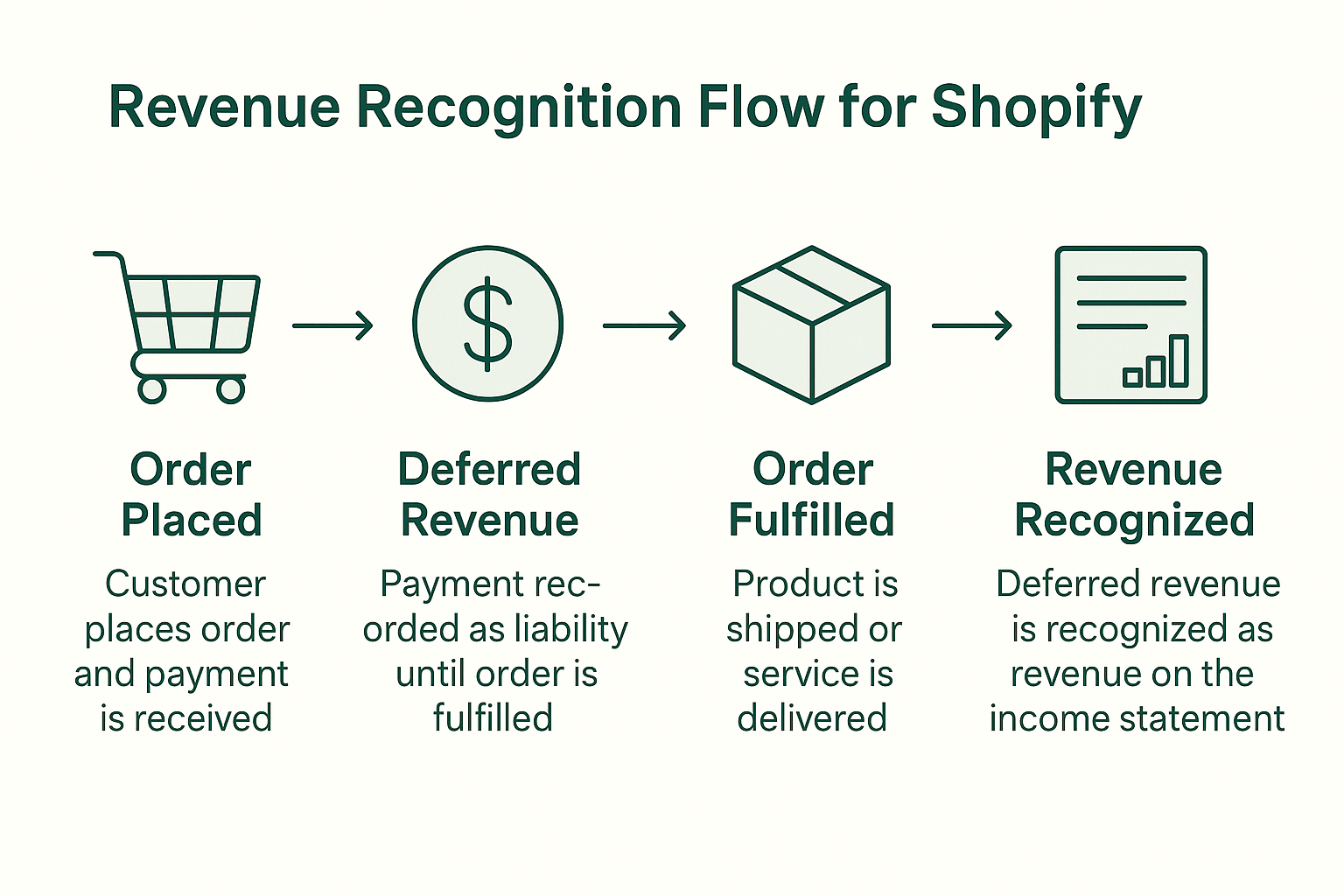

In the world of e-commerce, businesses often receive bank transfers or deposits from platforms like Shopify, Amazon, Walmart or eBay as part of their sales operations. While it may be tempting to record these transfers directly as sales revenue, doing so is an accounting error that can lead to significant financial misstatements.

Why booking bank transfers as sales is problematic

Bank Transfers/Deposits Are Not Sales

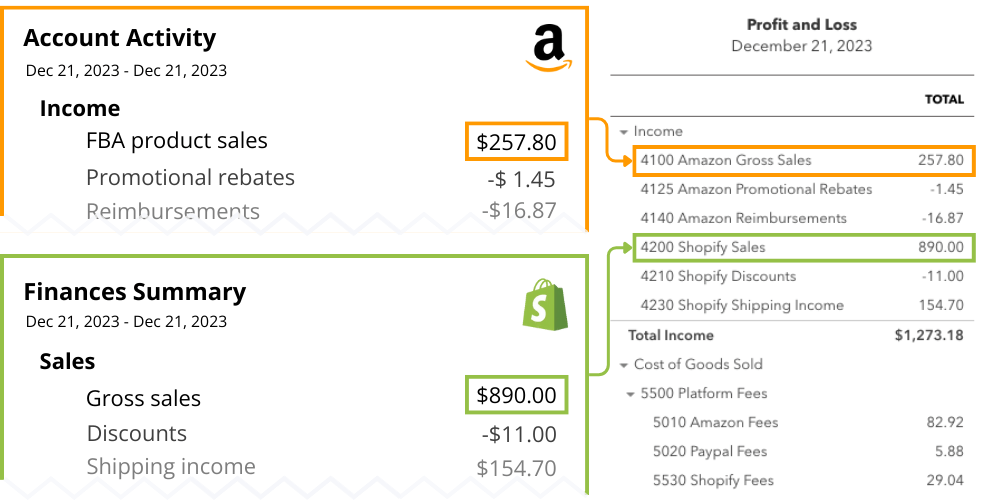

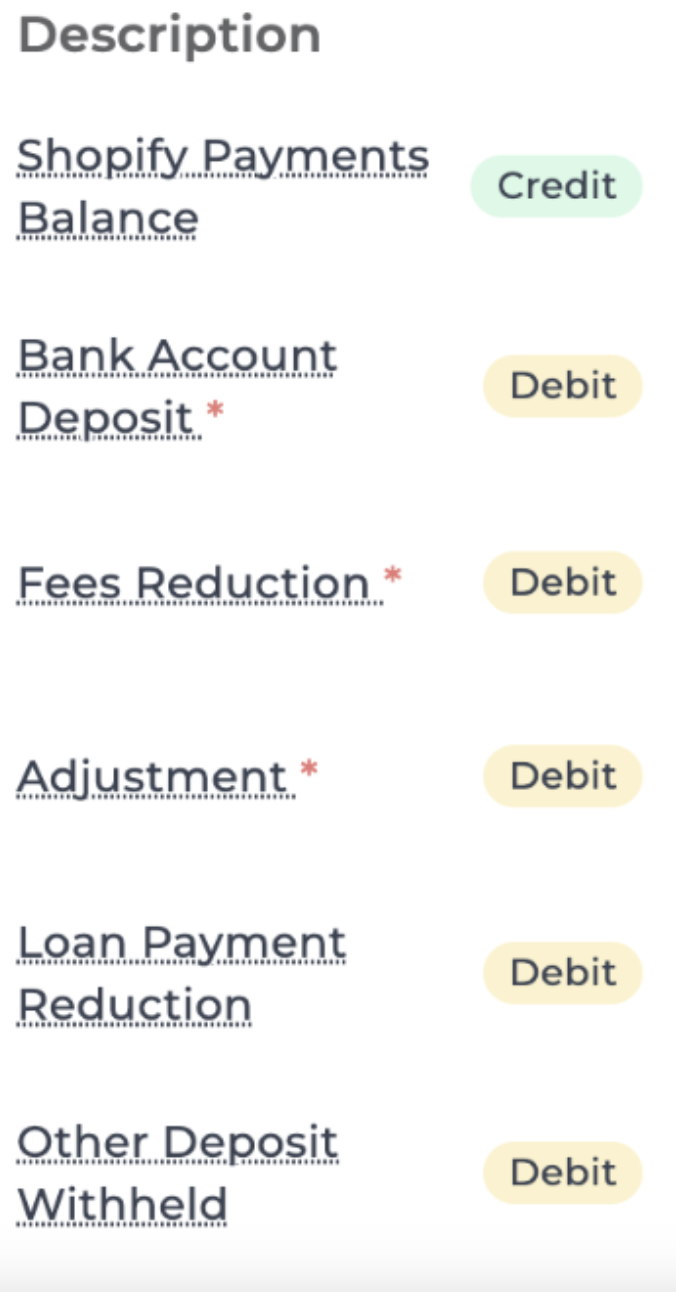

Bank transfers from e-commerce platforms are the net amount deposited into your account after various adjustments.These transfers often include:

- Deductions for platform fees (e.g., transaction fees, listing fees, or subscription fees).

- Deductions for refunds or chargebacks issued to customers.

- Deduction for loan repayments (e.g. Stripe Capital loans)

Recording the net transfer amount as sales ignores these deductions and does not reflect the gross revenue generated by your business. Sales should be recorded based on the total transaction value before any deductions.

Sales Tax Collected is Not Revenue

Many e-commerce platforms automatically collect sales tax or VAT on behalf of merchants. These amounts are included in the bank transfer but are liabilities, not revenue. Treating tax liabilities as sales revenue inflates your income and misrepresents your financial position. Taxes collected should be recorded as liabilities on your balance sheet until they are remitted to the appropriate tax authorities.

Fees and Adjustments Skew Revenue Recognition

E-commerce platforms often deduct fees directly from sales proceeds before depositing the net amount into your bank account. Examples include:

- Payment processing fees.

- Advertising fees (e.g., for promoted listings).

- Fulfillment fees (e.g., for Amazon FBA).

Recording the net transfer as sales ignores these expenses, leading to understated revenue. This misalignment distorts your profit margins and can result in poor decision-making based on inaccurate financial data.

Refunds and Chargebacks Must Be Accounted for Separately

Refunds and chargebacks reduce the net amount deposited into your account but do not negate the original sale. Proper accounting requires recording the initial sale as revenue and then separately recording refunds or chargebacks as a contra-revenue account. Failing to do so by booking only the net transfer obscures these activities and prevents accurate reporting of your gross sales and refund trends.

Best Practices for Accurate Revenue Recognition

To avoid these pitfalls, e-commerce businesses should adopt the following set of best practices.

Record Orders broken down by their Components

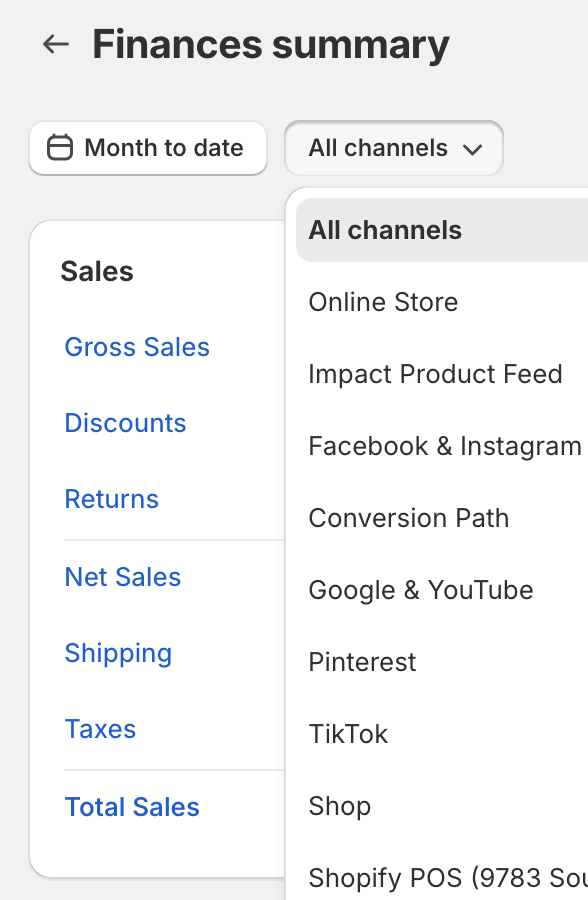

Use detailed sales reports from your e-commerce platform to record gross sales, taxes collected, fees deducted, and refunds issued. This provides an accurate breakdown of revenue and expenses.

Separate Taxes and Liabilities

Account for sales tax or VAT collected as liabilities, not revenue. This ensures compliance and prevents overstating income.

Deduct Fees as Expenses

Record platform fees, payment processing charges, and other deductions as expenses in the appropriate accounts.

Reconcile Bank Transfers

Regularly reconcile the net amounts deposited into your bank account with your platform’s payout reports. This ensures all transactions are accounted for and matches your accounting records.

Automate Accounting Processes

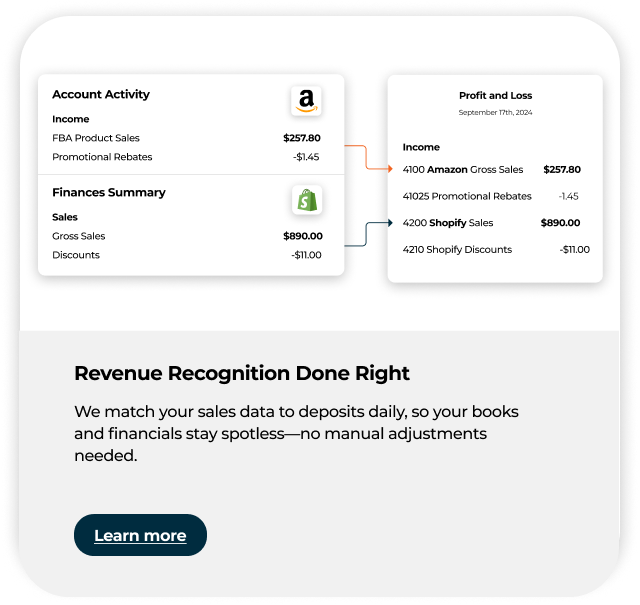

Consider using accounting automation tools that integrate with your e-commerce platforms. These tools can automate the breakdown of sales, taxes, fees, and deposits, ensuring accurate and efficient bookkeeping.

Conclusion

Booking bank transfers as sales is a common accounting mistake that can lead to inaccurate financial statements, compliance risks, and distorted business insights. By recognizing the components of these transfers and adopting proper accounting practices, businesses can ensure accurate revenue reporting, maintain compliance, and make informed decisions based on reliable financial data. Taking the time to set up robust accounting processes now will pay dividends in the long run, safeguarding the financial health of your e-commerce business.

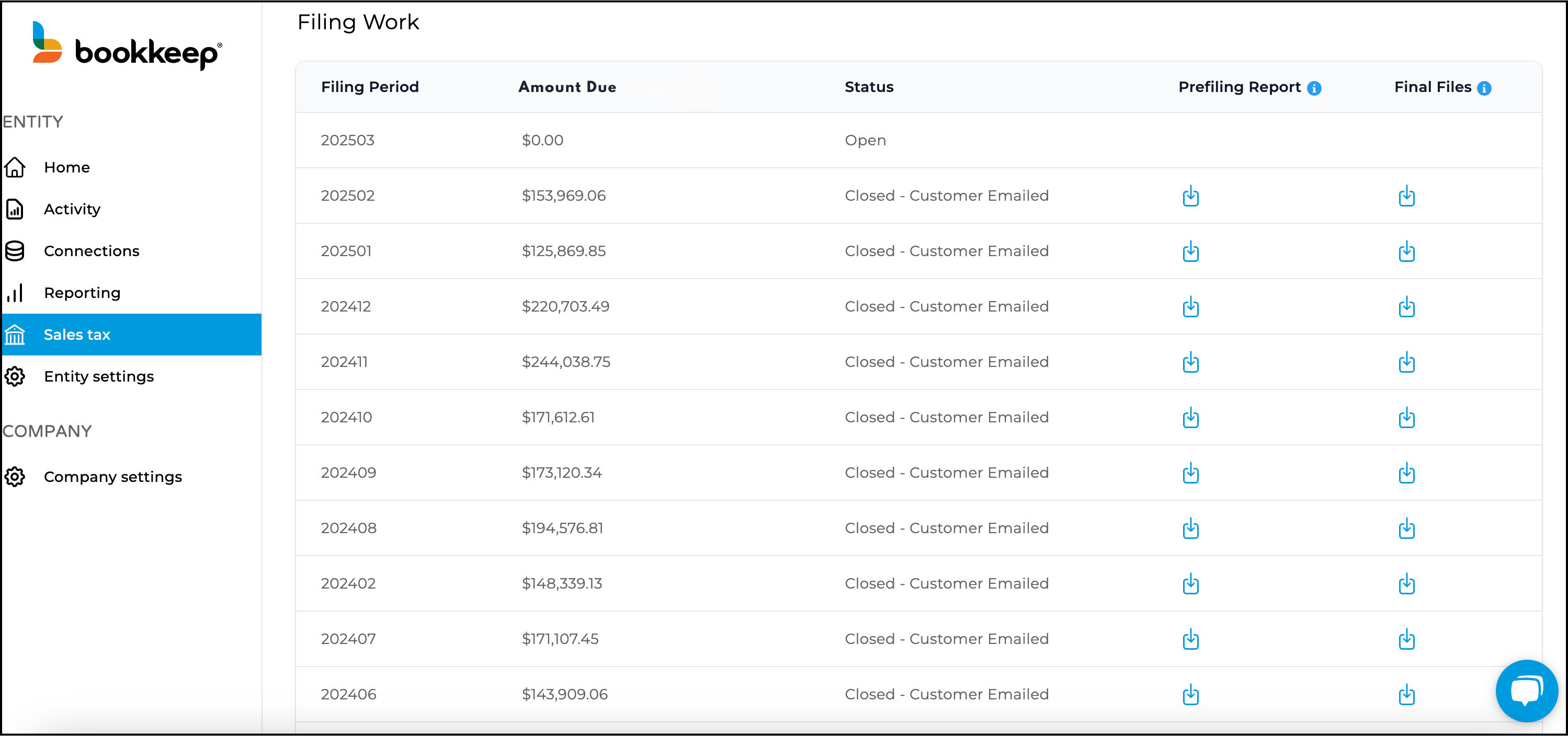

Be wary of accounting automation platforms that incorrectly book your deposits as revenue. Bookkeep's revenue accounting automation platform ensures proper accounting principles are followed and you have accurate sales reporting in your accounting or ERP system. Learn more by starting a free trial or booking a demo below.

%201.svg)